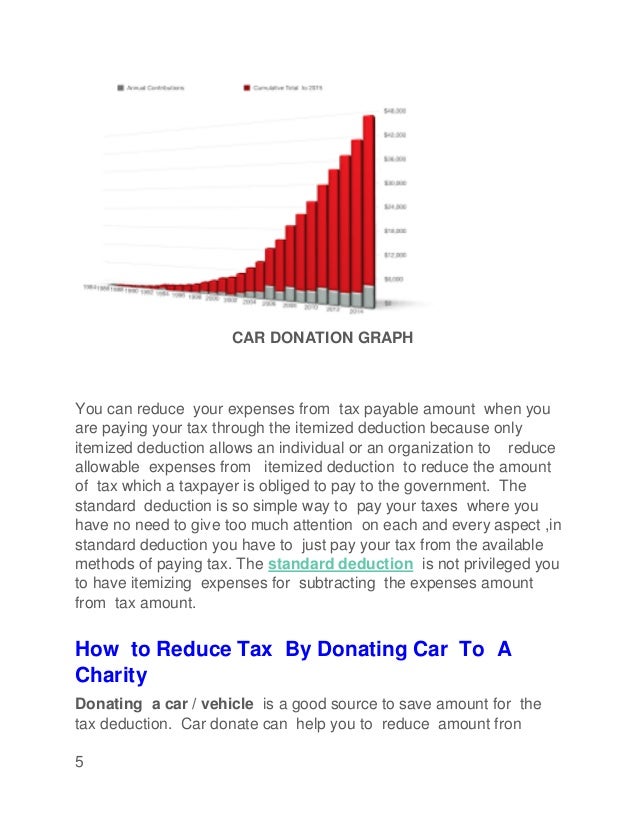

CharityWatch gives RMHC's national office a grade of A. The watchdog says the organization uses 88% of its budget for programs (versus overhead) and spends $9 to raise every $100 of.. Tax Benefits Of Donating A Car. Here's how the tax deduction works: When you donate a car in good condition, it will most likely be sold at an auction; if this is the case, the sale price is what determines your car donation tax deduction (rather than its fair market value). Cars that don't get auctioned may be sold for salvage.

DONATE CAR FOR TAX CREDIT

DONATE CAR FOR TAX CREDIT YouTube

Donate Car For Tax Credit, How To Get Tax Deduction For A Car Donation?

Donate car for tax credit canada Insurancest816 YouTube

Where To Donate Car For Tax Deduction Donate Kelloggs NYC

DONATE CAR FOR TAX CREDIT YouTube

Donate Car for Tax Credit 1 YouTube

Donate car for tax credit YouTube

Car Donation How To Donate A Car For Tax Deduction How Information Center

DONATE CAR FOR TAX CREDIT YouTube

Donate Car for Tax Credit YouTube

DONATE CAR FOR TAX CREDIT YouTube

Donate Car For Tax Credit v46 YouTube

How to donate car for tax deduction complete guide.pdf

Donate Car for Tax Credit Aruqic

Donate Your Car to Charity Best Vehicle Donation Charities How To Get Tax Deduction

Donate Car For Tax Credit Brain tech YouTube

Donate Car for Tax Credit 03 YouTube

DONATE CAR FOR TAX CREDIT YouTube

Donate Car for Tax Credit YouTube

For a deduction, report the vehicle's fair market value on IRS Form 1098-C. For a credit, report the deduction amount on Form 1040. Be sure to keep records of the donation in case of an IRS audit. By donating your used car to charity, you can get a tax benefit to lower your tax bill or increase your refund in 2024.. Are you interested in donating your car to a charitable organization and reaping the rewards of a tax credit? You've come to the right place! In this detaile.